Best Insurance for Electric Cars (EV) in India – Details Price and Discount

Insurance for Electric Cars: In India, demand for electric vehicles (EVs) is slowly increasing. They are not only a greener alternative to gasoline and diesel vehicles, but they can also be less expensive to operate in the long run. Because India’s EV market is still expanding, potential purchasers may be concerned about finding proper Electric Car Insurance.

Table of Contents

Best Insurance for EV Cars

Automobile manufacturers are creating several types of electric vehicles to fulfill the various needs of private purchasers in order to meet the growing demand. With the increased usage of electric vehicles, new-age insurance companies are now offering electric car insurance.

The Electric automobile insurance policy provides money protection for your vehicle against liability like accidental injury, fire, natural disasters, riots, stealing of the insured vehicle, and injury or injury to 3rd parties, within the same method that automobile insurance policies for petrol and diesel vehicles do. The property you will lower your owed payments by selecting the proper coverage for your electrical vehicle.

Why Do Electric Cars Need Insurance?

Here are some awesome benefits of your electric car with a full insurance policy.

1. Protect Against Third-Party Liabilities

In the awful situation that you cause injury to a third party or damage to third-party property, your insurance coverage will cover these responsibilities.

2. Avoid Expensive Repair Costs

Because the Comprehensive Cover includes Own Damage (OD) coverage, it covers a significant portion of the repair bill in the event of accidents, fire, natural calamities, riots, and theft losses. This means that if the plan covers damages, you won’t have to pay a hefty repair price.

3. Avoid Law-Mandated Penalties

Because the Comprehensive Plan includes the law-mandated Third-Party Liability Cover, you will be protected from non-compliance penalties when it comes to auto insurance.

4. Get a Personal Accident Cover

You get entire financial compensation under the law-mandated Personal Accident cover (PA) against uncertainties such as accidental death, bodily injuries, or partial/total impairments as a result of an accident. This must be acquired in addition to either the Third-Party Insurance Plan or the Comprehensive Plan.

Electric Vehicles Insurance Plans in India

1. Third-Party Car Insurance Policy

The automobiles Act of 1988 mandates that you simply insure your electrical vehicle with this insurance. This coverage will cover any liability arising from third-party injury or property damage caused by your electric vehicle. If your car is damaged in an accident, this coverage does not apply.

2. Comprehensive Car Insurance Policy

This is an outstanding automotive insurance policy for your electric vehicle. It provides coverage for both Third-Party (TP) and Own Damage (OD) (OD).

If your car is damaged as a result of riots, vandalism, floods, storms, accidents, or other causes, ACKO will cover the repair expenses according to the terms and conditions of your insurance.

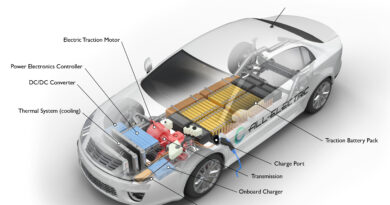

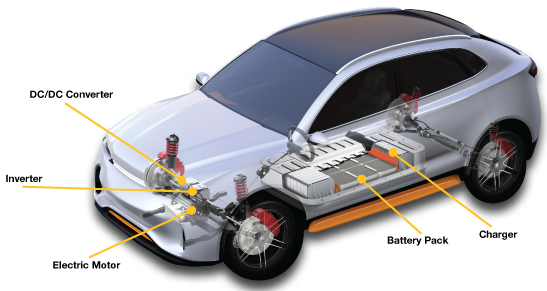

What is Covered Under the New Electric Vehicle Comprehensive Policy?

Many features and perks come included with comprehensive electric car insurance. Damage or loss occurring from the following situations is covered by the comprehensive plan.

- Damage to third-property parties or injuries to a third party.

- Damages of your own electric car in an accident.

- Damage to the electric car in fire or explosion.

- The owner-death driver’s or injury as a result of an accident.

- Natural disasters such as earthquakes, floods, storms, etc.

- Damage in man-made disasters such as riots, vandalism, etc.

- Losses caused as a result of car theft.

What is Not Covered Under the New Electric Vehicle Comprehensive Policy?

- Electrical or mechanical failure has caused damage.

- Normal wear and tear create damage.

- Damage due to careless driving.

- Damage due to driving an electric vehicle without a valid license.

- Damage due to driving your EV under any influence of alcohol or other intoxicating substances.

Requirement For Electric Car Insurance Policy

Here are some main reasons why you must have a car insurance policy if you don’t have it.

- Legal Mandate: The Motor Vehicle Act regulates the laws that apply to automobiles. To be lawfully driven on public roads, all vehicles are required to carry auto insurance. If you do not comply, the traffic police may levy hefty fines against you. A more recent change to the law now mandates that every new car purchased be covered by three-year liability coverage.

- Third-Party Liability: Minimum liability coverage is nearly often included in auto insurance policies. In the event of a collision involving other drivers, pedestrians, or property, you will be responsible for paying for your own injuries and damages. You don’t have to worry about any financial or legal liability if you have liability insurance.

- Protection Against Damages: In the case of an accident, your vehicle could be stranded. Anyone who has worked in the vehicle repair industry knows that they aren’t inexpensive. If you or someone else causes damage to your car, your car insurance coverage will cover the costs of repairs.

- Personal Accident Cover: In addition, car insurance regulations give private coincidence coverage for the insured. This factor comes into play if the insured dies as a result of a freak accident or suffers a lasting injury. The beneficiaries of the policy will get a lump sum payment that will aid the family financially.